In the current state, the market seems to be looking for a bright spot in the sky, which is drawn in by dark stormy winds. While some investors focus on profits, one of the largest investment banks, Goldman Sachs, is more interested in profitable stocks that generate high sales growth. He identified 13 companies from the S index.&P500 that meet this requirement.

The upcoming reporting season for the I quarter will be one of the most hype in our memory

It is assumed that it will become a positive factor for the market, which is forced to overcome one difficult obstacle after another. First, the trade war between the United States and China made a good noise, then high-profile investigations in the technology sector, and then Donald Trump’s Twitter storm directed at Russia.

Goldman Sachs, known among the financiers as The Firm, analyzing this situation, said that it advises traders to focus on maximizing sales, rather than on profit figures.

Reducing tax pressure can provide a good incentive for the growth of corporate profits. In such circumstances, it will be more difficult to understand which companies have achieved this through their own efforts, and not due to relaxation..

But do any teams stand out from the rest, if you pay attention to sales? Even The Firm itself said it expects revenue growth of just S&P500 at 10% in the first quarter. This is the most “fast” achievement since 2011.

Fortunately, the company simplified the decision by updating its basket to a set of 50 companies, whose sales are expected to grow the most in 2018. Goldman Sachs expects that its index, covering 10 out of 11 major industries, will increase revenue by 15% this year. Compared to median S&P500 (+ 6%).

Without further ado, we suggest that you familiarize yourself with the list of 13 companies that the “company” predicts the most outstanding sales growth in 2018.

[Note: Stock prices and indicators in the article are indicated at the time of publication.]

Profitable shares 13 companies

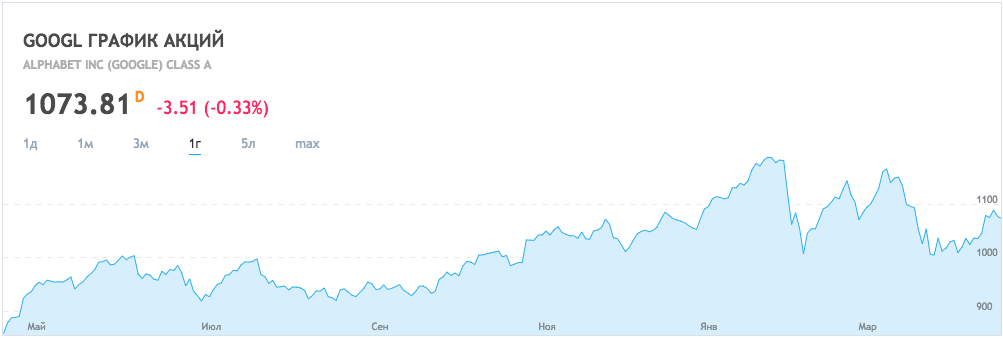

13. ALPHABET INC (GOOGLE) (NASDAQ:? GOOGL)

Source: tradingview.com

• Industry: Information Technology

• Market cap: $ 621 billion.

• Expected sales growth in 2018: 21%

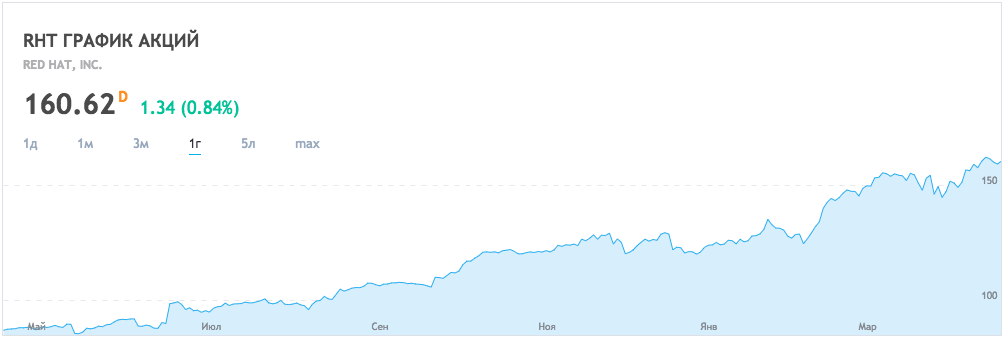

12. RED HAT INC (NYSE:? RHT)

Source: tradingview.com

• Industry: Information Technology

• Market cap: $ 27 billion

• Expected sales growth in 2018: 21%

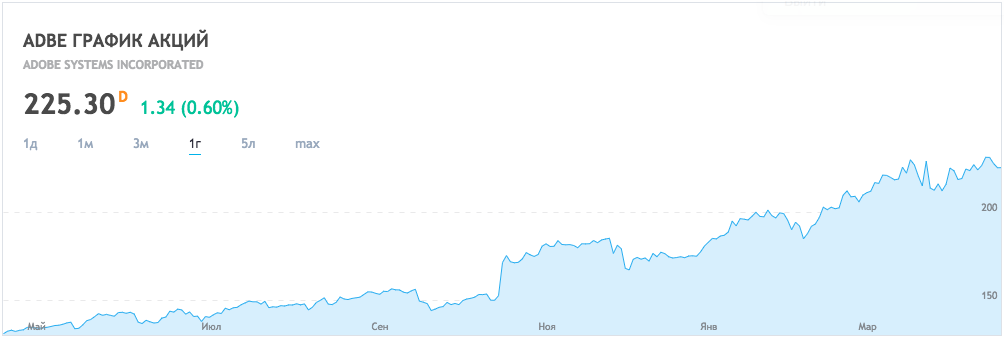

11. ADOBE SYSTEMS INC (NASDAQ:? ADBE)

Source: tradingview.com

• Industry: Information Technology

• Market cap: $ 110 billion

• Expected sales growth in 2018: 23%

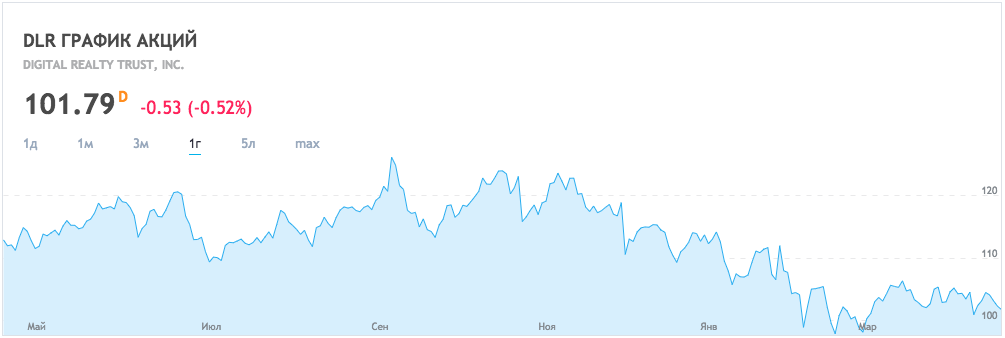

10. DIGITAL REALTY TRUST INC (NYSE:? DLR)

Source: tradingview.com

• Industry: Real Estate

• Market cap: $ 22 billion

• Expected sales growth in 2018: 25%

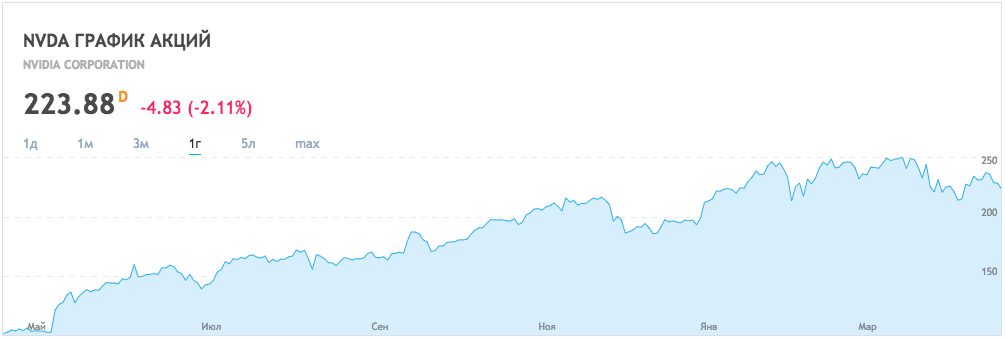

9. NVIDIA CORP (NASDAQ:? NVDA)

Source: tradingview.com

Which companies are included in the list of profitable shares, and what factors contribute to their surprising income levels that will impact the market?

Could you provide more information on the 13 companies mentioned in the article? How did they manage to generate such shocking income and what factors contributed to their profitability?