Semiconductor Stocks

In recent years, semiconductor stocks have been among the hottest in the stock market. For example, Nvidia Corp. papers. [NVDA] grew by more than 1000% in three years.

Data from Bank of America say that over the year the number of supporters of such companies among fund managers is declining. But there is no reason to talk about the decline in popularity and the rollback. Look at these promising stocks of semiconductor companies that are in good condition..

[Note: Stock prices and indicators in the article are indicated at the time of publication. You can see the current stock prices in a special widget at the end of the text. Before buying stocks, always do your own analysis. Investing money carries the risk of losing it. This article was published for review, not a call to purchase.]

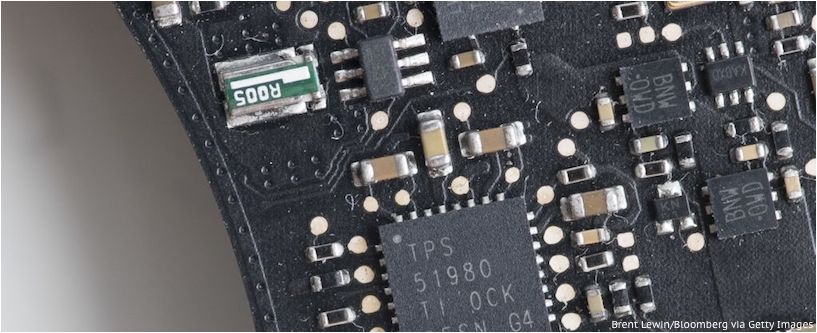

1. Texas Instruments [NASDAQ  TXN]

TXN]

• Stock Price: $ 101.09

Texas Instruments – manufacturer of semiconductor elements, microcircuits, electronics and products based on them.

The shares of this company did not keep up with the frantic growth rate of Nvidia over the past 3-4 years, but over the year showed an increase of 21%. Bank of America analysts say Texas Instruments diversification and consistent development history make the company a good choice for long-term investment..

TXN is the most popular stock of semiconductor companies among stock managers. They are stored in 33.3% of actively managed organizations. Bank of America gives them a “buy” rating with a price target of $ 133.

2. Broadcom [NASDAQ: AVGO]

• Stock Price: $ 232.95

Singapore Semiconductor Product Development Company.

Broadcom had a difficult 2018. The potential merger with Qualcomm [QCOM] was blocked by the US government, and the redemption of CA Technologies for $ 18.9 billion has been widely criticized. Bank of America experts are also among the critics and say the deal will negatively impact growth.

In 2018, the price of [AVGO] fell by a few percent, but many managers are betting on recovery. Broadcom shares are held by 31.3% of stock organizations. Bank of America estimates buy with a price target of $ 300 per share.

3. Intel Corp. [NASDAQ: INTC]

• Stock Price: $ 44.88

Intel is a manufacturer of electronic devices and computer components, microprocessors and chipsets.

The company is not an industry leader. But investors give them preference because of security and 2.5% of dividend yield. INTC – one of the most common semiconductor stocks among managers – 30.6% of funds have this asset.

Experts also talk about potential difficulties. The release of a 10-nanometer processor is delayed, and chip security issues remain. Bank of America estimates INTC neutral and recommends a target price of $ 56 per share.

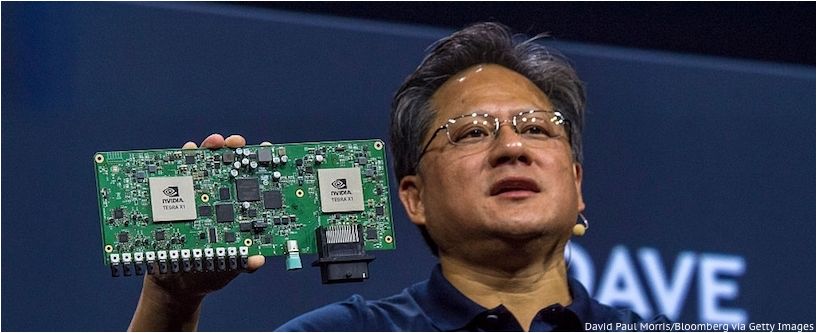

4. Nvidia Corp. [NASDAQ  NVDA]

NVDA]

• Stock Price: $ 246.54

Nvidia – the largest developer of graphics accelerators, processors and chipsets.

The stocks of semiconductor companies that are popular with stock managers are more likely to be conservative investments. Nvidia is the opposite of this. Nvidia Papers is the quintessential growth of the tech industry. Over the past five years, the company’s revenue has grown by 190%, and the share price – by 1740%.

There are prerequisites for continued growth in the future due to the launch of the Turing generation architecture. According to Bank of America, NVDA needs to “buy” with a target price of $ 360 per share.

5. Qualcomm [NASDAQ: QCOM]

• Stock Price: $ 64.29

This company is engaged in the development and research of wireless communications..

Qualcomm investors ride a roller coaster in 2018. After blocking Broadcom’s potential buyback, Qualcomm canceled their planned deal with NXP [NXPI] on their own, agreeing to pay a penalty.

Instead of growing through a merger, QCOM decided to invest $ 30 billion in a share buyback program. According to experts, this is a good signal for investors. QCOM shares are held in 28% of active fund organizations, and Bank of America advises buying them with a target price of $ 75.

6. Applied Materials [NASDAQ: AMAT]

• Stock Price: $ 33.69

AMAT is an American corporation that supplies equipment, services and software for the production of semiconductor chips, electronics, flat panel displays for computers, smartphones, televisions and solar panels.

Applied Materials sank 23.9% in 2018. But among experts, the opinion is popular that investors should look for an opportunity to buy shares during this period of recession. The diversification of AMAT products, technical excellence, top-level service and scale make the company one of the main companies in the semiconductor market. Applied Materials shares are held in 27.8% of active funds. According to Bank of America, they have a neutral status with a target price of $ 49.

7. Analog Devices [NASDAQ: ADI]

• Stock Price: $ 84.17

ADI is a large company, a manufacturer of integrated circuits for solving signal conversion problems.

Analog Devices shares have several positive long-term catalysts. Half of the company’s sales are related to industrial partners, that is, it is a key supplier of products for large market players.

Analog Devices also comes under the positive influence of the massive shift to 5G wireless networks. She cuts borrowed funds on her balance sheet and plans to resume the share buyback program by $ 2 billion. Bank of America gives a buy signal with a target of $ 112.

8. Lam Research Corp. [NASDAQ: LRCX]

• Stock Price: $ 143.61

LRCX is an American corporation that designs, manufactures, markets, and services semiconductor process equipment used in integrated circuit manufacturing..

Lam Research is another leader in the semiconductor industry, which turned out to be outside the rally in 2018. Shares fell 5.6%. According to analysts, the decline in supplies in September by 20% (compared with the previous quarter) confirms that they will not fall below the current level of LRCX. Lam Research Corp. plan to complete a $ 4 billion buyback program in the next 9 months. They get a neutral rating from Bank of America with a target price of $ 200.

9. Micron Technology [NASDAQ: MU]

• Stock Price: $ 42.47

A multinational corporation known for its semiconductor products, the bulk of which are DRAM and NAND memory chips, SSDs and CMOS sensors.

Analysts say there are three reasons to take a closer look at MU. Firstly, the company’s profit grew due to higher prices for the sale of hardware. Secondly, Micron mitigates risks by using cash flow to balance and buy back stocks. Third, long-term management strategies should protect Micron Technology papers from the deep cyclical recessions that have occurred in the past. Bank of America recommends buying with a target price of $ 85.

Similar entries:

Similar articles

- These shares have grown by more than 1500% in 10 years.

These shares have grown by more than 1,500% in 10 years. There are companies on the stock market that have given investors a fortune if they are at the right time…

- Expensive stocks worthy of buying – Top – 10 assets

Some investors prefer cheap stocks, others tend to expensive offers, in fact, the value of specific assets does not have…

- The most profitable stocks with an increase of more than 200% in two years

What makes the company the best investment option these days? The ability to double investment in a year or faster, if possible. If now…

Can you provide more information about the latest technological advancements and products being developed by Texas Instruments?