The content of the article

- What is a Host card from Russian Agricultural Bank

- How to get a

- Terms of the card of the owner of the Agricultural Bank

- How to use a credit card of the Agricultural Bank

- Pros and Cons of the Host Card

Many financial institutions try to attract new customers by promising benefits, bonus programs. Russian Agricultural Bank issued a host credit card, which has positive reviews. It is useful to learn how to fill out an application, terms and conditions of its application, pros and cons.

What is a Host card from Russian Agricultural Bank

A feature of this banking product is the refund of part of the amount spent on purchases (cashback). The owner’s credit card from Rosselkhozbank works on the basis of MasterCard, Visa payment systems. Its validity period is 3 years; money is stored in rubles.

The first 3 months of banking services are free. It will remain the same if you connect the “Host” promotion code, you will make purchases of 10,000 rubles. in 30 days. Under other conditions, a monthly fee of 150 rubles is charged. Two additional cards can be ordered to the main card, for example, for a child.

Positive feedback from customers has the implementation of the Agricultural Bank of the bonus program for cashback for a number of services and goods.

The choice of option can be done every month or left unchanged. Refunds with cashback of 5 and 10% – a maximum of 2000 rubles. Compensation for other categories – no more than 5000 rubles. per month.

On this card, a part of the paid amounts is returned to the client:

- 10% for online games, books, music, films, a pharmacy.

- 5% for visiting the theater and cinema, cafes and restaurants, the purchase of cosmetics and perfumes, toys, gasoline, diesel fuel or gas at gas stations.

- 1% by bank transfer in other sales and service points.

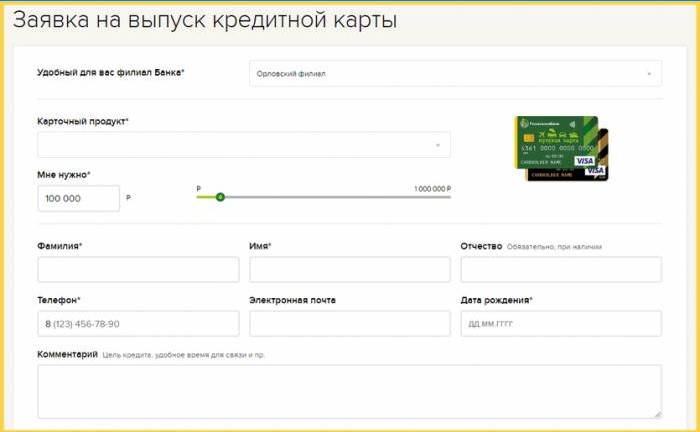

How to get a

Citizens of Russia aged 21 to 60 years can become a member of the loan program. The total length of the borrower’s seniority is at least a year, at the last place of work – from 4 months.

The client should consider some features:

- Methods of obtaining:

- Come to the office of the organization, write a statement, submit a package of documents.

- Get a credit card at Rosselkhozbank online on the official website.

- Documents:

- application on a special form;

- passport of a citizen of the Russian Federation;

- income statement NDFL-2;

- other solvency document.

- Procedure Procedure:

- After accepting the application, the decision to issue a loan is made within 5 working days.

- The manager notifies the result by phone.

- Come to the bank office, get a credit card. If you need money right away, you should activate it through an ATM or by calling a support service. Otherwise, it will happen in 24 hours.

Terms of the card of the owner of the Agricultural Bank

According to customer reviews, they are attracted by a large grace period and a high limit on receiving cash. Terms of the Russian Agricultural Bank card:

- Annual interest rate – from 23.9%.

- Loan amount – up to 1 million rubles.

- The card is issued free of charge..

- Cashback – from 1, 5, 10%.

- Loan term is 3 years..

- The grace period of the card is 55 days. It applies only to non-cash payments, does not apply when receiving money from an ATM.

- Every month you need to pay 3% of the amount plus interest.

- Service – the first year is free, then – 400 or 900 rubles, which depends on the type of credit card.

- For cash withdrawals at an ATM after three months of using the card, they charge 3.9%, the minimum amount is 350 rubles.

- Penalties in the absence of payment within the specified period are 20% per annum.

- Up to 250 thousand rubles can be cashed out per day, no more than 500 thousand per month.

How to use a credit card of the Agricultural Bank

- It is more profitable to conduct cashless transactions. So you can return part of the money spent, do not pay a large percentage when withdrawing cash from an ATM.

- The owner of the credit card can connect SMS banking or view information in the personal account of Internet banking.

- Using a Visa card, it is easy to make transactions from your phone. To do this, connect the services of Android Pay, Apple Pay, Samsung Pay, Garmin Pay. To replenish the account, enter the credit card or contract number.

- An important condition – you need to refund the entire amount during the grace period, so as not to pay additional interest.

- You can make transfers between customers of the Agricultural Bank or to cards of other financial institutions.

- It is easy to pay for mobile communications, taxes, utilities through an online banking system or ATMs.

Pros and Cons of the Host Card

Positive feedback on the use of a loan product:

- year of service for free;

- convenient cashback program;

- large loan amount;

- the possibility of increasing the limit;

- the application is easy to complete online;

- the ability to recharge from cards of other banks without losing money;

- average interest rate;

- it is easy to generate a statement through the Internet bank showing all amounts and dates.

Minuses:

- high cash withdrawal fee;

- no information on the maximum bid;

- the imposition of additional services;

- the commission is debited even if you do not use the card;

- you need to keep all receipts from purchases for six months;

- no interest on the balance;

- problems with closing a credit card.

Can you please provide more information about the features and benefits of the Host Credit Card from Russian Agricultural Bank?

The Host Credit Card from Russian Agricultural Bank offers a range of benefits and features to its users. Some of the key features include a competitive interest rate, no annual fee, and a generous credit limit. Cardholders also have access to discounts and special offers at selected merchants, as well as the ability to earn rewards points for every purchase made with the card.

Additionally, the Host Credit Card provides access to exclusive travel insurance benefits, including coverage for lost luggage, trip cancellations, and medical emergencies while traveling. Cardholders can also enjoy a range of lifestyle benefits, such as concierge services, dining discounts, and access to airport lounges.

Overall, the Host Credit Card from Russian Agricultural Bank is a versatile and valuable financial tool that offers convenience, rewards, and peace of mind to its users.

I understand this text mentions the availability of a host credit card from the Russian Agricultural Bank. However, my question is: What specific benefits or features does this credit card offer compared to other credit cards in the market?

The host credit card from the Russian Agricultural Bank offers various benefits and features that set it apart from other credit cards in the market. Some of the specific advantages include lower interest rates, exclusive discounts and promotions, rewards programs tailored to agricultural needs, flexible repayment options, and priority customer service for agricultural businesses. Additionally, the card may offer specialized insurance coverage for agricultural products and equipment, as well as access to financial tools and resources specifically designed for farmers and rural businesses. Overall, the host credit card provides unique benefits that cater to the specific needs of individuals and businesses in the agricultural sector, making it a valuable option for those in the industry.