The content of the article

- Ways to transfer money to a Sberbank card

- Translation Restrictions

- How much can be transferred to Sberbank card as much as possible

- At the bank branch

- Via Sberbank Online

- SMS team

- The maximum amount on a Sberbank card through an ATM

- Using “Sberbank Mobile Bank”

Credit and financial institutions set transaction limits, not allowing customers to uncontrollably make money transfers from bank cards. This is done to ensure the safety of the card user, since there is a possibility of a technical malfunction and personal funds may be at risk of access to fraudsters. Therefore, for numerous customers of the largest domestic bank, the relevant questions are: what is the maximum transfer amount to the Sberbank card set and what are the ways to transfer large amounts.

Ways to transfer money to a Sberbank card

Before you begin to transfer funds, you need to study all the available methods of transactions and decide on a suitable method for yourself, taking into account the allowed volume and tariffs. On the official website of Sberbank, the following ways of transfer are indicated:

- directly at the bank branch;

- in the Sberbank Online mobile application

- at bank ATMs;

- through the Internet service “Sberbank Online”;

- SMS team by phone.

Translation Restrictions

The size of the daily transaction limit depends on the transfer option and the type of card. Thus, Platinum and Gold cardholders are allowed to operate with larger cash volumes than, for example, Classiс standard holders. In addition to the daily limit on payments, a limit on the number of transactions is established. When owning several Sberbank cards, the daily maximum limit is set not on the card, but on the holder – on the total amount of all transactions made by the client.

With any chosen option or their combination, the daily maximum threshold starts from the first tranche. It should be noted that transfers in foreign currency will be available only through cash management services in bank divisions. Another important point – payments between credit cards are not made, they are only allowed to replenish.

How much can be transferred to Sberbank card as much as possible

Currently, the bank has set the following maximum daily limits (as indicated on the organization’s website in the “Instant card transfers” section):

- when using the Sberbank Online mobile application – a maximum amount of 500,000 rubles is allowed;

- for transfer with the help of an SMS command – a daily limit of 8,000 rubles has been established with a limit of ten tranches per day;

- when instructed via the Sberbank Online web version, the maximum daily amount of up to 1,000,000 rubles is available;

- at the bank branch, payments are unlimited.

A transfer operation from a debit card of Sberbank to a card of another credit institution is possible by the recipient’s card number: it can be VISA, MasterCard of any type of issue. The maximum allowed amount of 1 payment is 30,000 rubles; a day total of 50,000 p. – for Visa Electron / Maestro cards, for other cards – 150 000 r. The order is executed within 5-10 minutes, the service is available through online services and self-service devices.

At the bank branch

It is convenient to transfer money through a bank branch in that with this method there are no limits, regardless of the type of card issue, but with this option you will have to personally visit the bank’s office with a passport. Two ways of transfer are possible here: through a personal account and through a debit card. A client can transfer using a card to a card of another recipient, knowing the full name, the card number of the person receiving the money.

No other information is required, but a fee will be required for servicing the bank with such treatment. A commission fee is not charged for transactions within the same city. There is no commission provided when transferring to credit cards to pay off debt. When the recipient and the sender are in different regions of the country, the commission is set at 1.5% of the transferred amount (minimum 30 rubles and maximum 1000 rubles per operation).

This tariff is not tied to the maximum amount threshold. Sberbank provides such a service within its single system, that is, both participants must be the owners of the cards of this financial and credit organization. Payment is carried out in a few minutes. In the absence of a card or by wire transfer to a third-party bank, money is transferred from account to account.

To do this, you need to know the full bank details for the payment, providing them to the operator of the Sberbank branch, and deposit cash into the account through the cashier. The size of the commission within Sberbank is similar to the above, but when sending money to another financial institution, the commission is already 2% (minimum 50 rubles and maximum 1500 rubles for the operation). With such orders of the client, the lead time can be several days (according to the rules – up to five working days).

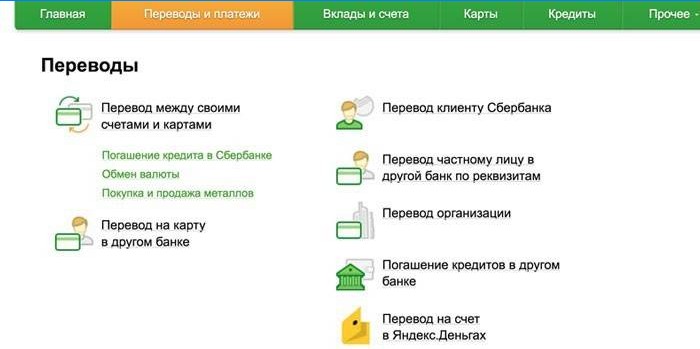

Via Sberbank Online

To make transfers through the web version of the Sberbank Online service, you need a computer, a connection to the service itself and an Internet connection. It’s easy to figure out the convenient service interface: in the menu, select “Transfers and payments”, fill in the fields, wait for a one-time password to be received on the phone, confirm the transfer by entering the received password. The limitation of the amount per day depends on the type and purpose of the transaction:

- payment to customers of Sberbank – 1 million rubles;

- mobile communications payments (MTS, Megafon, etc.), for electronic wallets – 10,000 rubles;

- transfer from deposit to social card – 1 000 000 p. and not more than 2 payments per day;

- transfer to another bank using MasterCard and Visa payment and settlement systems technology implies limits for specific types of issue:

- Visa, MasterCard – 30,000 for one operation, 150,000 rubles / day and 1,500,000 rubles / month;

- Visa Electron, Maestro, MasterCard Standard Momentum, Visa Classic Momentum – 30 000 p. for one operation, 50,000 p. / day and 1,500,000 p. / month.

SMS team

Knowing the recipient’s card number, money transfer can be done via mobile phone. To do this, you must connect the full package of SMS services “Mobile Bank”. An SMS notification must be sent to the short special number “900”, where a message should be issued with such text — the word “Transfer”, the recipient’s phone number and the transfer amount. The maximum transfer from phone to Sberbank card is limited to 8,000 rubles and ten transactions per day.

The maximum amount on a Sberbank card through an ATM

Another method of payment on a card is the use of self-service terminals, ATMs. In the menu on the display, the option “Payments and transfers” is selected, then “Transfer of funds” and then you need to follow the prompts on the screen. For difficulties and problems, you need to contact the specialists of the Bank’s Call Center. The daily limited threshold through the self-service devices is set as follows:

- the total amount per day for all transfer operations of the client – 301 000 p .;

- amount on one card:

- Visa Gold, MasterCard Gold, World MasterCard, Visa Platinum, Platinum MasterCard, World MasterCard, Black Edition, Visa Infinite, World MasterCard Elite – 301 000 p .;

- Visa Classic, MasterCard Standard – 201,000 p.;

- Maestro, Visa Electron, Maestro Momentum, Visa Electron Momentum, PRO100, MasterCard Standard Momentum, Visa Classic Momentum – 101 000 r.

Using “Sberbank Mobile Bank”

The Mobile Bank service is a quick and convenient way both when paying for purchases, and when transferring money online to other cards, your own or another person. The mobile application is activated through the personal account of the bank’s web version, or for this you need to personally contact the bank office. To perform a transfer operation with this method, you must:

- have a smartphone;

- connect to the internet;

- install the Sberbank Online mobile application;

- execute commands with the name of the recipient or his phone number or card number;

- observe the daily limit – 500 000 r.

What is the maximum amount that can be transferred to a Sberbank card? Also, could you please explain the different ways in which this transfer can be made?

The maximum amount that can be transferred to a Sberbank card depends on various factors such as the account type and individual limitations. Generally, the maximum daily transfer limit for individuals is set by the bank and can vary from country to country. To find out the specific maximum amount for your card, it is recommended to check with Sberbank directly.

As for the different ways to make transfers to a Sberbank card, there are several options available. These include:

1. Online transfers: Through Sberbank’s online banking system or mobile app, you can initiate a transfer from your bank account to a Sberbank card using the recipient’s card number.

2. Bank branch: You can visit a physical Sberbank branch and request a transfer to a Sberbank card by providing the necessary details such as the recipient’s card number and your account information.

3. ATM transfers: Some ATMs allow you to transfer funds directly to a Sberbank card. This method usually requires you to insert your bank card, enter the recipient’s card number, and follow the on-screen instructions.

4. Money transfer services: Certain money transfer services like Western Union or MoneyGram also provide the option to transfer funds to a Sberbank card. These services typically require you to visit one of their locations, provide the necessary information, and pay the transfer fees.

It is important to note that specific transfer methods and availability may vary based on the country and the services provided by Sberbank in that region.