The content of the article

- Differences between debit cards and deposits

- What contribution can be opened with Tinkoff Black

- Smart contribution

- Savings account

- How to replenish SmartVklad and savings account

- Terms of using the card as a debit

- Differences between Tinkoff Black and Tinkoff Black Metal

- Interest on the balance

- Cashback on the map

- Service cost

- Tinkoff Deposit Debit Card Features

- Free currency transfers

- Other features

- Tariffs and limits for withdrawal and transfer of funds

- How to open a deposit card in Tinkoff Bank

- Documents for registration

Tinkoff payment instruments can be used not only for purchases, withdrawals, but also for storing funds. Moreover, interest is charged for this. A bank client gets access to his personal account and the opportunity to open a deposit. He can withdraw and withdraw money to the account through payment plastic. For this reason, the Tinkoff debit card is often called escrow..

Differences between debit cards and deposits

Debit card – This is an electronic wallet where you can only store personal funds (no credit line). They are used to pay for various services, money transfer, cash withdrawal. Funds that are in the account are equated with deposits and insured.

Deposit (bank) deposit – This is the money that a person gave to a credit institution in order to receive interest income. They appear in the course of financial transactions and are paid for a certain time period, which is selected at the conclusion of the contract. The longer the money is, the higher the rate.

What contribution can be opened with Tinkoff Black

The Bank offers to issue a Smart Deposit or Savings Account. The first option is suitable if the amount is large, and in the near future it will not be needed. For early withdrawals, interest is charged. A savings account is suitable for those who have little free money, and they don’t know how soon they will need the funds – in 3 days or six months. Interest on cash withdrawals will not be lost, but the bank can change the rate without warning the client.

Smart contribution

| Currency | Min deposit amount | Annual interest rate | Deposit term |

| Ruble | 15 thousand. | 5.5-6.5 | 3-24 months. |

| U.S. dollars | 100 | 0.5–1.5 | |

| Pounds | There is no data | ||

| Euro | 0.01 |

You can withdraw part of the money from Smartvlad without waiting for the deposit to expire, but there are limitations:

- You can withdraw funds no earlier than 60 days after opening an account, if the contract is not concluded for a shorter period.

- When withdrawing money prematurely, almost all interest is lost in terms of 0.01% per annum.

Advantages of SmartVklad

- The ability to replenish the deposit in order to increase the amount of the account, and with it to get a big profit.

- Interest is accrued monthly on a Tinkoff card or deposits, for each currency separately. If they are not removed, they will be added to the main amount, and the percentage will be higher next month (this is capitalization).

- You can attach a new currency at any time..

- The rate is fixed. It does not decrease until the deposit expires..

- Money inside the deposit can be converted (e.g., convert rubles into dollars, euros). The interest is not lost, the commission is not taken. The course is as close as possible to the exchange.

- Funds from a deposit that was closed on schedule can be withdrawn without commission at any ATM.

- To the account for a period of 12 months. a bonus is accrued – 0.5% per annum. It disappears if you withdraw money ahead of time.

- The deposit can be opened and closed through the online account.

- The client withdraws funds to a Tinkoff Black card or another, and then withdraws it from an ATM.

- The deposit is insured. If the account has less than 1.4 million rubles, and the bank goes bankrupt, the user will receive them back.

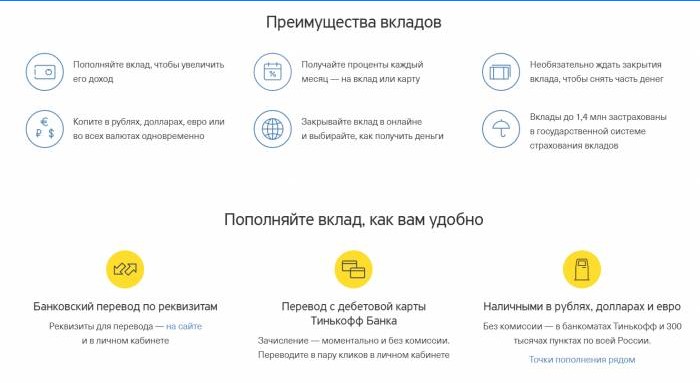

Savings account

If you need money constantly, it’s more profitable to make a savings account. There is no minimum amount required to open a deposit or withdraw funds. You can close it at any time without losing interest. The rate does not depend on the term – 5% in rubles, 0.1% per annum in another currency.

How to replenish SmartVklad and savings account

- Transfer from a Tinkoff Bank debit card. You can do this in your account through a computer or smartphone. The procedure is performed instantly, no commission.

- Bank Transfer.

- Cash through ATMs of Tinkoff and its partners without interest.

Terms of using the card as a debit

Information is in the information department of your personal account, on the bank’s website, as well as in the contract, which is signed when the courier brings the card to the customer. If you don’t have time to search for information, you can call the multi-channel number and ask a consultant.

Differences between Tinkoff Black and Tinkoff Black Metal

Tinkoff Bank deposit cards have similar terms of use. Metal gives more bonuses with cashback, the amount of free transfers between banks is higher. It is more expensive to maintain if the client could not fulfill the conditions necessary for free use..

Comparative characteristics of two banking products:

| Tinkoff black | Tinkoff black metal | ||

| Card issue | free | ||

| Interest on account balance | 6% in rubles | ||

| Cashback | there is | there is | |

| Fee for using the card, if the conditions for free maintenance are not met | 99 rub / month. | 1990 rub / month. | |

| Free transfers between banks | up to 20 thousand rubles. | up to 50 thousand rubles. | |

| Free recharge card | + | + | |

| Withdraw without commission | at any ATM in the world | from 30 to 100 thousand (depending on the bank) | + |

| in Tinkoff devices | up to 500 thousand rubles. | no limit | |

Interest on the balance

The amount that remains at the end of the month on the Tinkoff Black debit is given interest:

- Ruble account. They charge 6% per annum if the card is up to 300 thousand rubles. For everything that exceeds this amount, interest is not charged. An additional condition is that the client must make purchases from 3 thousand rubles with a card within a month.

- Foreign currency account – charge 0.1% per annum if the amount on the balance does not exceed 10 thousand dollars / euro. The client must make a card purchase for any amount. Otherwise, interest is not charged.

If a Tinkoff deposit card has more money than you need to earn interest, the problem is easy to fix. It is necessary to transfer part of the funds to the savings account. Money is transferred instantly and without commission through a personal account in a computer or smartphone.

By default, Tinkoff Black opens with a tariff of 3.0, the conditions of which are described above. There is another plan – 6.2. It is intended for employees of those companies that participate in the salary project of the bank. Upon dismissal, this plan is canceled, the client is transferred to the standard. According to user reviews, the tariff can be issued without working for such a company, just by calling an online consultant.

Interest accrued on cash balance:

| Condition | Amount | Percent |

| up to 100 thousand rubles. | 0% | |

| A client made purchases worth 3 thousand rubles with a card. | from 100 to 300 thousand. | 7% |

| more than 300 thousand. | 3% | |

| An individual made purchases of up to 3 thousand rubles. | from 100 thousand rubles. | 3% |

| No purchases | have the right amount | 0% |

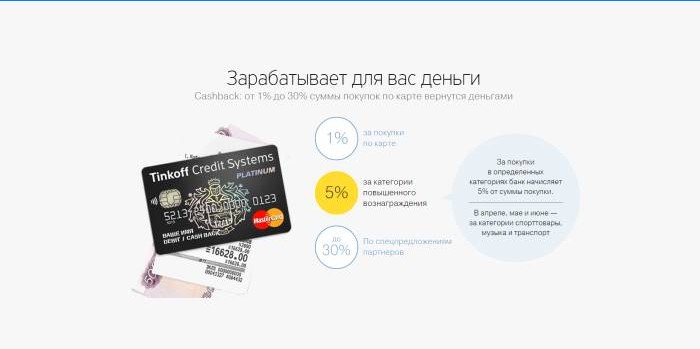

Cashback on the map

When calculating the bonus, 100 rubles is taken as the basis. This means that when you buy for 200 rubles., You will be returned 2 rubles., 300 rubles. – 3 rub. If you spent 299 rubles, the bank will give only 2 rubles, since the amount will be rounded down. When buying 99 rubles. do not wait for cashback.

Bonus size:

| Cashback | Tinkoff black | Tinkoff black metal |

| with partners | up to 30% | |

| for any purchases in online stores, ground-based retail outlets, etc.. | 1% | |

| increased cashback in three selected categories | 5% | |

| bonus for replenishment of deposit in any currency | no | 0.5% |

| Travels | no |

|

Service cost

Services are free if the deposit is connected to plan 6.2. Standard price on a Tinkoff Black payment card, tariff 3.0. – 99 rubles / month. There is no need to pay if the following conditions are met:

- The bank has opened a deposit on which at least 50 thousand rubles are deposited.

- Loan issued to the client.

- The amount on the debit card exceeds 30 thousand rubles.

The price for the maintenance of Tinkoff Black Metal will cost more than 1990 rubles / month. The service is provided free of charge in such cases:

- On the account there are 3 million rubles.

- In a month, the client paid with a card for purchases of 200 thousand rubles.

Tinkoff Deposit Debit Card Features

The owner of the plastic can pay for purchases on the Internet and in simple stores where the terminals are installed. Debit is convenient to pay for utilities. If you set up a regular payment in your account, you can’t forget about the payment. The card allows you to withdraw cash at any ATM in the world. If this is the apparatus of Tinkoff or his partners, the commission is not withdrawn (within the limit).

Free currency transfers

Thanks to the Tinkoff debit card, you can make a currency transfer not only between your accounts, but also to another person. The internal transaction is free, the external – 15 euros / dale. In Russia, a foreign currency transfer is a prohibited operation, so the procedure proceeds according to this scheme:

- You go to your personal account.

- Send dollars or euros to the contract number of your friend’s currency account.

- The bank turns dollars into rubles, transfers them to another client.

- Then the rubles are converted into the initial currency.

- All operations go at a single fixed rate, so a friend receives a transfer without commission.

Other features

- Free online services. The client can control and manage their finances through the application on a smartphone and Internet banking. Access to online services is always open anywhere in the world..

- Multicurrency card (more than 30 currencies available). It is convenient for travelers who can win on money conversion..

- Loyalty programs – cashback, bonuses, interest on account balance.

- Ability to set the maximum amount per day (month). This will not only prevent unnecessary expenses on the card, but also protect the money. In case of hacking, the hacker will not be able to withdraw all funds.

- Overdraft – short-term debit card loan. It is given for a short period (e.g. a month), at the end of which the entire amount must be returned. In case of delay – a fine. If the client has spent up to 3 thousand rubles, the interest is not charged. There is a concept – “technical overdraft.” It is counted when the time has come for the next payment for banking services, but there is no money on it. They will be debited as soon as they appear on the account..

Tariffs and limits for withdrawal and transfer of funds

| Service | Tinkoff black | ||

| rub. | Dollars and euros | ||

| Transfer | Interior | is free | |

| External | is free | 15 $ / € | |

| To another bank card | Free up to 20 thousand rubles. If the limit is exceeded – 15%, but not less than 30 rubles. | service unavailable | |

| Cash withdrawal | Via Tinkoff | Free up to 500 thousand rubles. | Free up to 5 thousand / month. |

| Through bank partners | Free of charge up to 100 thousand rubles / month, if the amount is withdrawn from 3 thousand rubles. If less than 3 thousand rubles are withdrawn, the commission is 90 rubles, more than the limit is 90 rubles. + 2%. | Free up to 5 thousand / month. If you need to withdraw up to 100 euros / dol., Commission – 3 $ / €. If the limit is exceeded – 3 $ / € + 2%. | |

How to open a deposit card in Tinkoff Bank

A feature of a financial organization is the complete absence of ground-based branches. Applications for opening a deposit, deposit, loan are submitted online or via phone. To order a Tinkoff Black card, proceed as follows:

- Go to the bank’s website, “Debit Cards” tab.

- Click on Tinkoff Black. If you want to familiarize yourself with the conditions, select the item “Details about the map”.

- An overview of the banking product opens. If you are interested in Tinkoff Black Metal, click on the “Premium” section..

- After reviewing the conditions, click on “Draw a card”.

- Fill out and submit the application form.

- The bank considers the application for 2 minutes. This is not a credit card, so in most cases a positive decision is made.

- In a couple of minutes the manager will call you back and clarify the information.

- In 1-2 days, the multi-currency card will be delivered by courier to your chosen address at a convenient time. He will verify the documents with a passport, ask to sign an agreement, explain how to proceed..

The card must be activated:

- Open the official website of the bank.

- Next, find the column where the activation code is entered. It is located in the Credit Cards section. Go to the Tinkoff Platinum section. There is a subsection “Activate”.

- Enter the number, card expiration date, your data.

- A PIN code will be sent to your phone.

- Create a personal account and use online banking.

You can activate a debit by phone:

- Dial the number indicated on the website or in the instructions for the card.

- Answer all operator questions correctly.

- After checking the data, the dispatcher will transfer you to an automated service that will provide a PIN code. It must be remembered.

- When the system asks if you wrote down the code, confirm. After that, activation will occur.

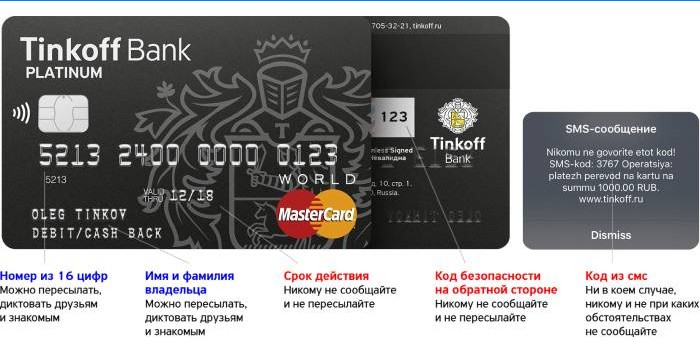

Important: when the Tinkoff debit card is in your hands, be sure to put the signature on the back with a ballpoint pen. Otherwise, it will be invalid, and problems may arise when paying through the terminal. It’s better to turn off paid services that you don’t plan to use when activating (SMS alerts, insurance, etc.).

Documents for registration

If you are a citizen of Russia, you only need a passport to receive a debit card. Non-residents can also open an account. A foreigner must prove that he lives in Russia. Depending on citizenship, you must provide a migration card, a patent for a job, a residence permit, a visa.

Hi there! I’m curious to know if Tinkoff Bank’s debit card can be used as a deposit for certain financial services. Can anyone provide more information on this? Thank you!

Yes, Tinkoff Bank’s debit card can be used as a deposit for certain financial services. The bank offers a range of products like savings accounts, investment accounts, and various deposit options where you can use your debit card to deposit funds. These services can be accessed through the bank’s online platform or mobile app, allowing you to conveniently make deposits and manage your finances. It’s advisable to visit Tinkoff Bank’s official website or contact their customer service for specific details on the financial services where the debit card can be used as a deposit.

Is the Tinkoff Bank debit card eligible to be used as a deposit for financial transactions?